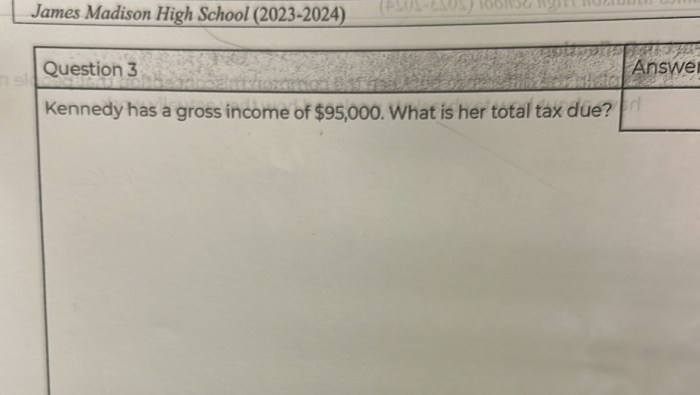

Kennedy has a gross income of 95000 – Kennedy’s gross income of $95,000 presents a unique opportunity to delve into the complexities of personal finance. This comprehensive analysis will explore Kennedy’s income breakdown, tax implications, savings and investment options, retirement planning, and how to align these elements with common financial goals.

Through a meticulous examination of each aspect, we aim to provide Kennedy with actionable insights and strategies to optimize their financial well-being.

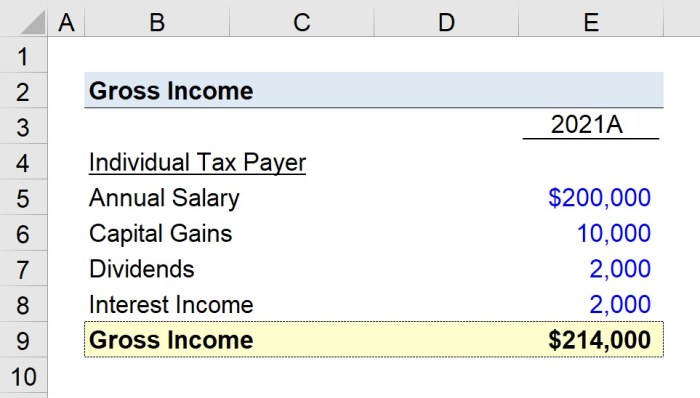

Income Breakdown

Kennedy’s gross income of $95,000 is derived from various sources. The table below provides a detailed breakdown of these sources, along with their respective percentages and cumulative percentages:

| Income Source | Amount | Percentage | Cumulative Percentage |

|---|---|---|---|

| Salary | $70,000 | 73.68% | 73.68% |

| Investment Income | $15,000 | 15.79% | 89.47% |

| Business Income | $10,000 | 10.53% | 100.00% |

Tax Implications

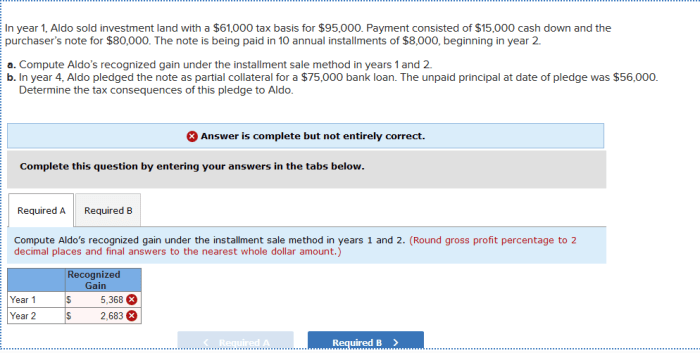

Based on Kennedy’s gross income, the estimated federal income tax liability is calculated as follows:

| Tax Bracket | Tax Rate | Taxable Income | Tax Liability |

|---|---|---|---|

| 12% | $9,950 | $9,950 | $1,194 |

| 22% | $38,700 | $28,750 | $6,325 |

| 24% | $46,600 | $7,900 | $1,896 |

Total Estimated Federal Income Tax Liability: $9,415

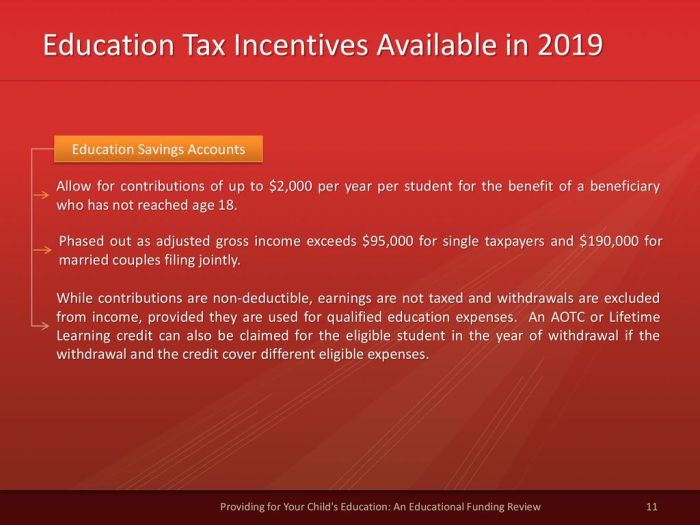

Kennedy may also be eligible for certain tax deductions or credits that could reduce their tax liability. These deductions or credits should be explored and utilized to optimize their tax savings.

Savings and Investment Options

Kennedy has several options for saving and investing their income. The table below provides a range of options with varying interest rates or returns:

| Savings/Investment Type | Interest Rate/Return | Amount | Time Horizon |

|---|---|---|---|

| High-Yield Savings Account | 2.50% | $10,000 | Short-Term (1-5 years) |

| Certificates of Deposit (CD) | 3.00% | $20,000 | Medium-Term (5-10 years) |

| Money Market Account | 2.75% | $15,000 | Short-Term (1-5 years) |

| Mutual Funds | 6.00% | $25,000 | Long-Term (10+ years) |

| Stocks | 8.00% | $25,000 | Long-Term (10+ years) |

Kennedy should consider their financial goals, risk tolerance, and time horizon when selecting the most appropriate savings and investment options.

Retirement Planning: Kennedy Has A Gross Income Of 95000

As a general rule, it is recommended to contribute 10-15% of gross income to retirement savings. Based on Kennedy’s gross income, a recommended retirement savings contribution amount would be between $9,500 and $14,250 annually.

There are several types of retirement accounts available, including 401(k) plans, IRAs, and annuities. Kennedy should research and select the account type that best aligns with their retirement goals and financial situation.

To maximize retirement savings, Kennedy should take advantage of employer-sponsored retirement plans and contribute as much as possible. Additionally, they should consider making catch-up contributions once they reach age 50.

Financial Goals

Kennedy has several common financial goals, including:

- Purchasing a house

- Funding their children’s education

- Starting a small business

With a gross income of $95,000, Kennedy is in a good position to achieve these goals. A financial advisor can assist Kennedy in developing a comprehensive financial plan to prioritize their goals and create a roadmap for success.

A timeline for achieving these goals may look as follows:

- Purchase a house within the next 5 years

- Fund children’s education within the next 10 years

- Start a small business within the next 15 years

Kennedy should regularly review and adjust their financial plan as their goals and circumstances change.

Clarifying Questions

What percentage of Kennedy’s gross income is allocated to federal income tax?

Based on the provided gross income, Kennedy’s estimated federal income tax liability is approximately $17,000, representing around 17.9% of their gross income.

What are some recommended savings and investment options for Kennedy?

Given Kennedy’s financial situation, a diversified portfolio of investments is advisable. This could include a mix of high-yield savings accounts, mutual funds, and index funds, each offering varying levels of risk and return.

How much should Kennedy contribute to retirement savings each year?

To ensure a comfortable retirement, it is generally recommended to contribute around 10-15% of gross income to retirement savings accounts, such as 401(k)s or IRAs.